“THE FAILURE OF THE PREPARATION IS THE PREPARATION OF THE FAILURE”

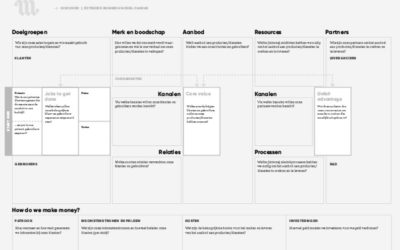

Partly through Alexander Osterwalder’s successful introduction of the Business Model Canvas in 2010, the concept of the business model has become indispensable for the arsenal of management instruments for start-ups and entrepreneurs. A business model describes the fundamental idea of how an organisation creates, supplies and maintains value, and makes profit from it. It forms a blueprint (often visual) for a strategy that is to be implemented in a company’s organisation structures, systems and processes.

Many companies and managers think that a business model is sufficient and that translating it into a concrete written business plan (with at least a swot analyse, strategic path, marketing plan and financial plan) is unnecessary.

A poor choice.

A business plan is certainly useful as a kind of internal management instrument for the company. It’s the documented version of an intense consideration and consultation process. Without this process at the heart of the company, a business plan is indeed unnecessary. Guidance in writing a plan can obviously add value, but it’s important that the thinking process is not exclusively left to third parties. Formulating a business plan teaches you to structure ideas, assess predefined hypotheses objectively, and gain insight into the feasibility of planned activities and the planning process. The business plan sets out the course for the company. It shows in detail how and where a company is going to compete in the future, and ultimately provides a well-calculated financial plan.

It is also a communication document for others; an external presentation document. The business plan is an instrument to convince potential stakeholders (financiers, partners, personnel, etc.) of the company’s direction and persuade them to become part of the story. Obviously the format of the business plan should be adapted to the target group. So a business plan for acquiring finance needs a different construction than for a plan to win an exclusive partnership with a supplier.

The preparation phase is very important for starters as well. To ensure that they don’t fail all to soon, it’s best to pay adequate attention in the business plan to the well-known starter pit-falls: wrong mix of equity capital/borrowed capital, overestimation of the market potential and market share, underestimation of the strength of the competition, wrong estimation of client needs, problems with delivery times, etc.

A business plan that concludes that it’s better not to launch an idea because it’s unviable undoubtedly also has a very high value.